Amanda Elhassen was a hairstylist drowning in $50K of credit card debt.

Her car was getting repossessed. She couldn't see a way out.

Then she discovered something that changed everything:

"Every single time I make a video, I'm talking to one person. Her name is Ducky."

Today, she sells $50M a year in real estate.

From her kitchen during lockdown, phone propped against a book, making what she calls "cringey videos" to becoming Livermore's top agent.

This playbook shows you her exact strategy

— Andrew

Part I: The 555 Formula That Broke $10M to $50M in Sales

Amanda works on her strategy every day, always striving to connect with people authentically.

Her focus on social media and creating genuine content has allowed her to build deep relationships within her community, which has been key to her success.

Part II: The Friend Who Made Her Millions (Without Knowing It)

Ducky has no idea she's the secret to Amanda's success.

Every morning, Amanda wakes up 45 minutes early. Not to meditate. Not to journal.

To have real conversations with strangers.

"I'll never DM someone 'Yum' or just heart their post. I'll say 'Oh my gosh, that's one of my favorite restaurants. I always get the salmon. What did you order?'"

Dead-end comments kill conversations; questions create clients.

Within messages about pasta and appetizers, people suddenly say:

"By the way, I've been meaning to connect you with my uncle who needs to sell his house."

She never asked for the business. She asked about the bruschetta

Part III: Why Going Everywhere Means Going Nowhere

Part IV: The Abundance Trap That Pays

Amanda's husband saves everything. Amanda spends everything.

"He's like 'We need to save for emergencies.' I'm like 'No, let's spend it. Money is so easy to make. We'll just make more.'"

Reckless? Maybe.

But watch what she did:

Bought first home with $14K (scraped together)

Took 1% higher interest rate to cover closing costs

Lived in 1,100 sq ft house while making millions

Fixed it up themselves for 2 years

Sold for $187K profit

Then the genius move:

Used a HELOC to buy an Airbnb. $2-4K monthly profit. Paid off the HELOC. Bought another.

"We lived like we were broke while making millions. My colleagues couldn't believe someone at my level lived in a house that small. But now we own our dream home AND the investments pay for it."

The Closing Loop

Amanda still has her stylist scissors.

Keeps them in her desk drawer. A reminder of the $50K debt, the sleepless nights, the almost-repossessed car.

But also a reminder of this:

"I never thought I'd even own a home. Now my girls run through our dream house's yard, picking fruit from our trees, and I can't believe I get to live here."

The distance between barely surviving and building wealth?

One conversation at a time. One DM about dinner. One question about dessert. One friend named Ducky who doesn't know she's famous.

Amanda's final truth:

"If you don't reward yourself for working hard, what's the point? Every six months I book a vacation while on vacation. If I don't have something to look forward to, why get out of bed?"

The hairstylist who couldn't afford her car payment now books vacations from other vacations.

All because she talked to people about restaurants.

WANT THE FULL STRATEGY?

Search How Hyper-Local Is the Most Underrated Strategy on YouTube or your favorite podcast app to watch the complete episode now!

Meet Thom Guerrero, the mortgage broker who grew from 2 to 6 businesses during a 2-year recovery from a near-fatal collision. After both parents died when he was 18 and a head-on crash nearly took both legs, he discovered why his worst times happened when he made the most money and the "fuel" that actually matters.

Key Insights:

$10K/month in garage payments while working 18-hour days including Christmas, his breaking point

Started in family business at 4th grade, closed dad's failing company at 19, hit panic attack at career peak

Made split-second decision during accident that saved his son's life but nearly cost his own

"You already paid for the lesson—grab the bag and go" philosophy on extracting value from failures

Launching FUEL conference to bring leadership development to Central Valley

Search How Nearly Dying Changed This Real Estate CEO's Life Forever on YouTube to watch the full episode now.

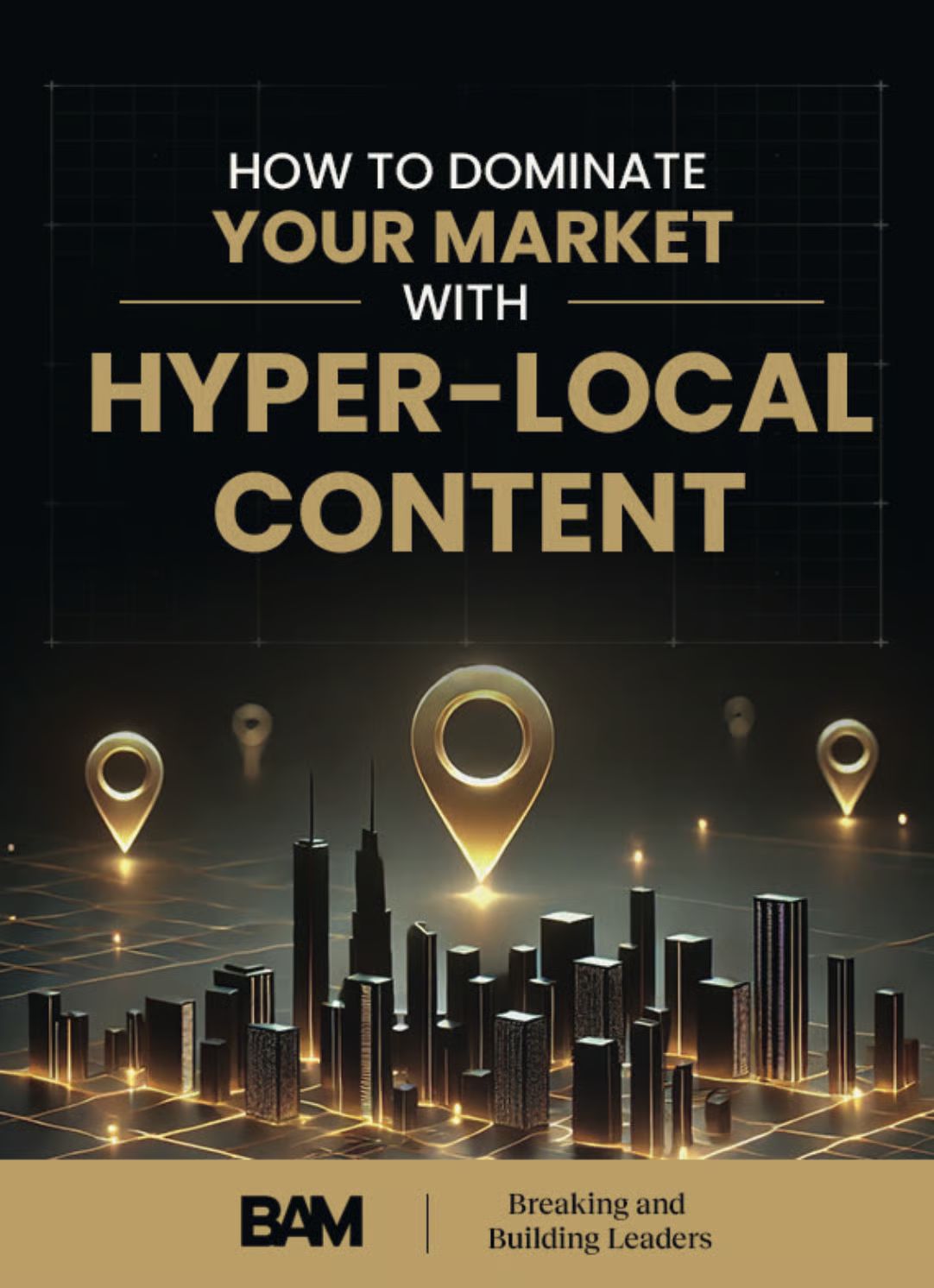

Kyle Talbot cracked the code: 600 to 76K followers in 12 months, $20M in sales, all by posting local news FIRST.

While agents post boring listings, he breaks development news and weather alerts.

His secret?

46x - Why Is Everyone Leaving {CITY/AREA}: What Buyers & Sellers MUST Know

24x - The {CITY/AREA} Market Is Splitting in Two | {CITY/AREA} Real Estate Market Update

4x - Never Buy These Types of Homes in {CITY/AREA}

3x - I Ranked Every {CITY/AREA} Neighborhood From WORST to BEST!

47x - MASS MIGRATION: Why Everyone Is Returning to {CITY/AREA} From Other Cities!

4x - These {CITY/AREA} Suburbs Will Explode in {YEAR}

8.1x - I’ve Lived in {CITY/AREA} for {X} Years - My Honest Thoughts

26x - {CITY/AREA} Is About to CHANGE Forever (Big Development Coming)

89x - This Will Be Worse Than A Housing Market Crash in {CITY/AREA}

11x - I Ranked {CITY/AREA}'s BEST & WORST Places to Live {YEAR} (Tier List)

2.2x - 7 Homes You Can’t Miss If You’re Buying in {CITY/AREA} (2025)

2.8x - The 10 Best Neighborhoods Where the Wealthy Live in {CITY/AREA}

I hope this inspires your next video!

Rapid Fire For Your Consumption:

Use this weekly real estate lead generation plan - Instagram

How to create a client database to transform the buy-curious into deals - RealScout

How ChatGPT Helps You Gain More Followers - Instagram

TOP 10 AI Tools for Real Estate Agents in 2025 - Brandon Upright

How to tell a story in under 1 min

Speak on YouTube like this to get views and make sales - Alexander The Create

What did you like most about the newsletter?

Here’s to a strong summer. Let’s keep building!

I appreciate you reading,

Andrew Bayon

P.S. Want more profit and leverage from your marketing? Find out how we help agents attract “come list me” sellers & “ready to transact” buyers with YouTube.

Forward this to a friend: